Your credit score is more than just a number — it’s a key indicator of your financial health. Whether you’re applying for a loan, renting an apartment, or even job hunting, your credit score can affect your opportunities and your future.

In this article, we’ll explain what a credit score is, how it’s calculated, why it matters, and what you can do to improve it. Let’s break it down in simple terms.

What Is a Credit Score?

A credit score is a three-digit number that reflects your creditworthiness — essentially, how likely you are to repay borrowed money. Lenders use this score to evaluate the risk of lending to you. The higher your score, the more likely you are to get approved for credit, and usually with better terms.

In the United States, credit scores generally range from 300 to 850. The most commonly used scores come from:

- FICO® Score – developed by the Fair Isaac Corporation

- VantageScore – developed by the three major credit bureaus: Equifax, Experian, and TransUnion

For a deeper explanation of how these scores work, visit myFICO’s official guide.

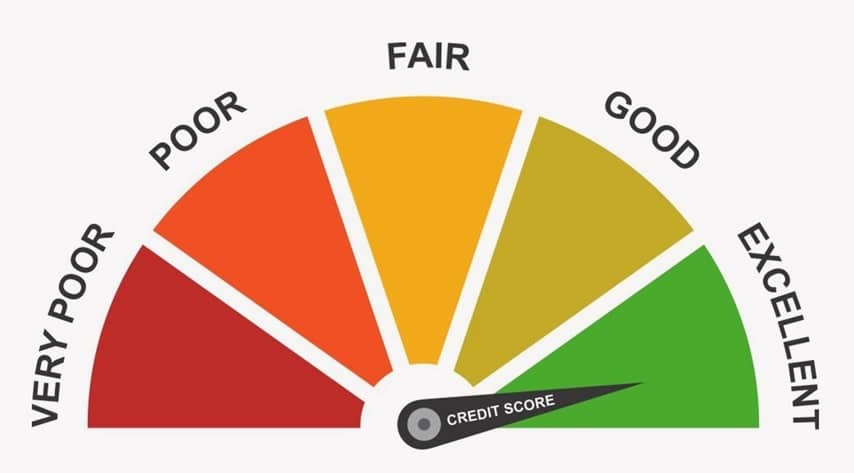

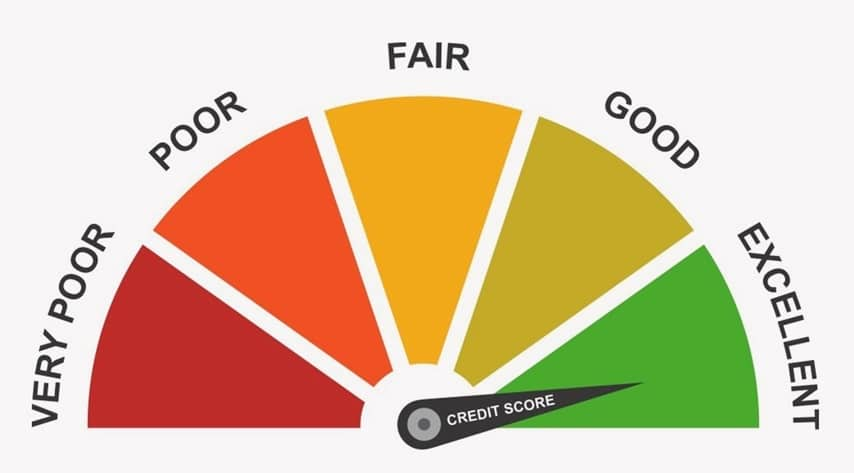

What Is a Good Credit Score?

Here’s a general breakdown of FICO score ranges:

- Excellent: 800–850

- Very Good: 740–799

- Good: 670–739

- Fair: 580–669

- Poor: 300–579

Each lender may interpret these ranges differently, but generally, a score above 700 is considered good, and anything above 750 is excellent.

See more on what’s considered a good score at Experian’s credit score range guide.

How Is Your Credit Score Calculated?

The FICO score is calculated using five main factors:

1. Payment History (35%)

Have you paid your past credit accounts on time? Missed or late payments can heavily impact your score.

2. Amounts Owed (30%)

Also known as credit utilization, this refers to how much of your available credit you’re using. Keeping this below 30% is ideal.

3. Length of Credit History (15%)

The longer your credit history, the better. This includes the age of your oldest account, your newest account, and the average age of all your accounts.

4. Credit Mix (10%)

A mix of different types of credit — credit cards, mortgages, auto loans — can help your score, as long as you manage them well.

5. New Credit (10%)

Opening several new accounts in a short time can be risky and may lower your score.

For full details on these factors, check out FICO’s breakdown of credit score components.

Why Does Your Credit Score Matter?

Your credit score affects much more than just getting a loan. Here are some key areas where it plays a role:

✅ Loan and Credit Card Approvals

Lenders rely on your score to decide whether to approve you and what interest rate to offer. A higher score means lower interest rates and better terms.

✅ Renting a Home

Landlords often check your credit score to decide if you’re a trustworthy tenant.

✅ Employment Opportunities

Some employers (especially in finance or government) may check your credit as part of the hiring process.

✅ Insurance Rates

Auto and home insurers may use credit scores to determine your premium rates.

How to Check Your Credit Score for Free

You’re entitled to a free credit report every 12 months from each of the three major credit bureaus through:

While this site provides your credit report, it does not include your credit score. However, many financial institutions and credit card companies offer free access to your score.

You can also use free platforms like Credit Karma or Credit Sesame to monitor your score regularly.

How to Improve Your Credit Score

Here are some proven strategies to help raise your score over time:

1. Pay Your Bills on Time

This is the single most important factor. Set reminders, automate payments, or use budgeting tools to stay on track.

2. Reduce Credit Card Balances

Try to keep your credit utilization below 30%, and ideally below 10%. This shows that you manage credit responsibly.

3. Don’t Close Old Accounts

Older accounts help your credit history length. Even if you don’t use them often, consider keeping them open.

4. Limit New Credit Applications

Each time you apply for credit, a “hard inquiry” appears on your report. Too many in a short time can hurt your score.

5. Dispute Inaccuracies

Mistakes on your credit report can bring your score down unfairly. Review your report and dispute any errors with the credit bureaus.

Learn how to dispute errors on your report via Consumer Financial Protection Bureau (CFPB).

Common Credit Score Myths

Let’s bust a few myths that still confuse many consumers:

- Myth: Checking my credit score lowers it.

Truth: Only hard inquiries (like loan applications) affect your score. Soft inquiries, like checking your own score, don’t. - Myth: I need to carry a balance to build credit.

Truth: You can build credit by paying off your full balance each month. Carrying debt is unnecessary (and costly). - Myth: Closing credit cards helps your score.

Truth: It may actually hurt it by increasing your credit utilization and shortening your credit history.

Final Thoughts: Take Control of Your Credit Future

Your credit score is not set in stone. With time, discipline, and smart financial habits, you can improve it. Start by checking your score, understanding what influences it, and making gradual improvements.

Whether you’re applying for a mortgage, financing a car, or just aiming for financial stability, a strong credit score is one of your best assets.

Useful Links Recap:

About the Author

0 Comments