Retirement is a major life event that requires careful planning and preparation. Whether you are in your 20s, 30s, 40s, or beyond, it is never too early or too late to start thinking about your retirement goals and how to achieve them.

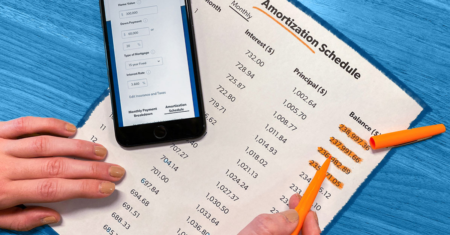

One of the most useful tools that can help you plan your retirement is a retirement calculator. A retirement calculator is an online tool that estimates how much money you need to save and invest for retirement, based on your current age, income, savings, expenses, and other factors.

Related articles

1- When is open enrollment for health insurance 2024

2- Health Insurance: Everything You Need to Know

3- What and Who Can Apply for Nations Benefits

4- Learn Here How to Apply SSDI Benefits

A retirement calculator can also help you answer questions such as:

- How much income will I need in retirement?

- How much will I receive from Social Security, pensions, or other sources of income?

- How long will my savings last in retirement?

- How much should I contribute to my retirement accounts each month or year?

- How will inflation, taxes, and investment returns affect my retirement income?

- What are the best ways to optimize my retirement strategy?

In this blog article, we will explain how to use a retirement calculator to plan your future, and provide some tips and resources to help you make the most of it.

How to Use a Retirement Calculator

There are many retirement calculators available online, each with different features and assumptions. However, most of them follow a similar process and require similar inputs.

Here are the basic steps to use a retirement calculator:

- Enter your personal information. This includes your current age, your planned retirement age, your life expectancy, your current income, and your current savings. You may also need to enter information about your spouse or partner if you are married or cohabiting.

- Enter your assumptions. This includes your expected income growth rate, your desired income replacement rate (the percentage of your pre-retirement income that you want to maintain in retirement), your expected investment return rate, and your expected inflation rate. You may also need to enter information about your tax situation, your Social Security benefits, your pension benefits, and any other sources of income that you expect to receive in retirement.

- Review your results. The retirement calculator will calculate how much money you need to save and invest for retirement, based on your inputs and assumptions. It will also show you how much money you will have in retirement, how long it will last, and how much you can withdraw each year. Some calculators may also provide graphs, charts, or tables to illustrate your results.

- Adjust your inputs and assumptions. You can change any of the inputs and assumptions that you entered in the previous steps and see how they affect your results. You can also test different scenarios by changing variables such as your retirement age, your income replacement rate, your investment return rate, or your withdrawal rate. This can help you explore different options and find the best strategy for your situation.

Tips and Resources for Using a Retirement Calculator

Using a retirement calculator can be very helpful for planning your future, but it is not a perfect tool. There are some limitations and challenges that you need to be aware of when using a retirement calculator. Here are some tips and resources to help you overcome them:

- Be realistic and conservative. A retirement calculator is only as good as the data that you enter into it. If you enter unrealistic or optimistic inputs or assumptions, you may get inaccurate or misleading results. Therefore, it is better to be realistic and conservative when using a retirement calculator. For instance, you may want to use lower estimates for your income growth rate, investment return rate, or life expectancy, and higher estimates for your inflation rate or expenses. This can help you avoid overestimating your retirement income or underestimating your retirement needs.

- Use multiple calculators. Different calculators may use different methods, formulas, or assumptions to calculate your retirement income or needs. Therefore, it is advisable to use multiple calculators and compare their results. This can help you get a more comprehensive and balanced view of your situation and avoid relying on a single source of information.

- Update your calculations regularly. Your situation and goals may change over time due to various factors such as changes in income, expenses, savings, investments, taxes, laws, health, family status, etc. Therefore, it is important to update your calculations regularly using the latest data and assumptions. This can help you monitor your progress and make adjustments if needed.

- Seek professional advice. A retirement calculator can provide a general overview of your situation and options but it cannot replace professional advice from a qualified financial planner or advisor. A financial planner or advisor can help you create a personalized and comprehensive retirement plan that takes into account all aspects of your financial situation and goals. They can also help you implement and manage your plan effectively.

Here are some examples of online retirement calculators that you can use:

- Retirement Calculator. This calculator can help with planning the financial aspects of your retirement such as providing an idea where you stand in terms of retirement savings, how much to save to reach your target, and what your retrievals will look like in retirement. It also allows you to test different scenarios by changing variables such as your retirement age, income replacement rate, investment return rate, or withdrawal rate.

- Pension Calculator. This calculator can help you estimate your retirement income from workplace schemes, private pension contributions, and state pension. It also provides a target retirement income to aim for based on your salary and allows you to see how increased contributions or taking a smaller tax-free lump sum affect your yearly pension.

- Retirement Calculator. This calculator can help you estimate your expected total retirement savings based on your annual contributions. It also shows you how much you need to save to make reality meet your expectations and provides some next steps to take if your pension incomes might be less than what you would want.

- Retirement Calculator. This calculator can help you predict how much money you need to retire based on your current salary and investment dollars and divides it by your post-retirement years. It also shows you how long your money will last in retirement based on different withdrawal rates and provides some tips and resources to help you save more.

- Retirement Calculator. This calculator can help you determine how much money you will need in retirement and how much you should save each month. It also shows you how much income you will have in retirement from various sources such as Social Security, pensions, annuities, etc.

Some other tools for retirement planning are:

- Retirement Budget Calculator. This is a tool that helps you estimate your monthly and annual expenses in retirement, based on your lifestyle choices, location, health, and inflation. It also helps you compare your expenses with your income sources and adjust your spending accordingly. You can find this tool at 1.

- Retirement Income Simulator. This is a tool that helps you project your retirement income from various sources, such as Social Security, pensions, annuities, savings, and investments. It also helps you account for taxes, fees, and withdrawals, and see how your income changes over time. You can find this tool at 2.

- Retirement Withdrawal Calculator. This is a tool that helps you determine how much money you can withdraw from your retirement accounts each year, without running out of money or paying too much taxes. It also helps you optimize your withdrawal strategy based on your age, life expectancy, account types, and tax rates. You can find this tool at 3.

- Retirement Savings Calculator. This is a tool that helps you calculate how much money you need to save for retirement, based on your current savings, income, expenses, and retirement goals. It also helps you see how different factors, such as inflation, investment returns, contribution rates, and employer matches affect your savings. You can find this tool at 4.

- Retirement Planner. This is a tool that helps you create a personalized and comprehensive retirement plan that covers all aspects of your financial situation and goals. It also helps you monitor your progress and make adjustments if needed. You can find this tool at 5.

About the Author

0 Comments