If you are thinking of taking out a loan, whether it is for a personal, business, or educational purpose, you might want to know how much you will have to pay back each month, how much interest you will pay over the life of the loan, and how long it will take you to pay off the loan. One of the tools that can help you answer these questions is an amortization calculator.

An amortization calculator is a tool that can help you estimate the monthly payments, the total payments, and the total interest of any amortized loan. An amortized loan is a loan that is paid off by equal periodic installments over a specified term. Some examples of amortized loans are personal loans, mortgages, car loans, and student loans.

Related articles

2- High Interest Savings Account

3- Principal Financial Group 401k

4- Certified Financial Advisor

An amortization calculator can help you plan your loan repayment by allowing you to compare different loan scenarios and options. For example, you can see how changing the loan amount, the interest rate, or the loan term can affect your monthly payments and the total cost of the loan. You can also see how making extra payments or paying off your loan early can save you money on interest.

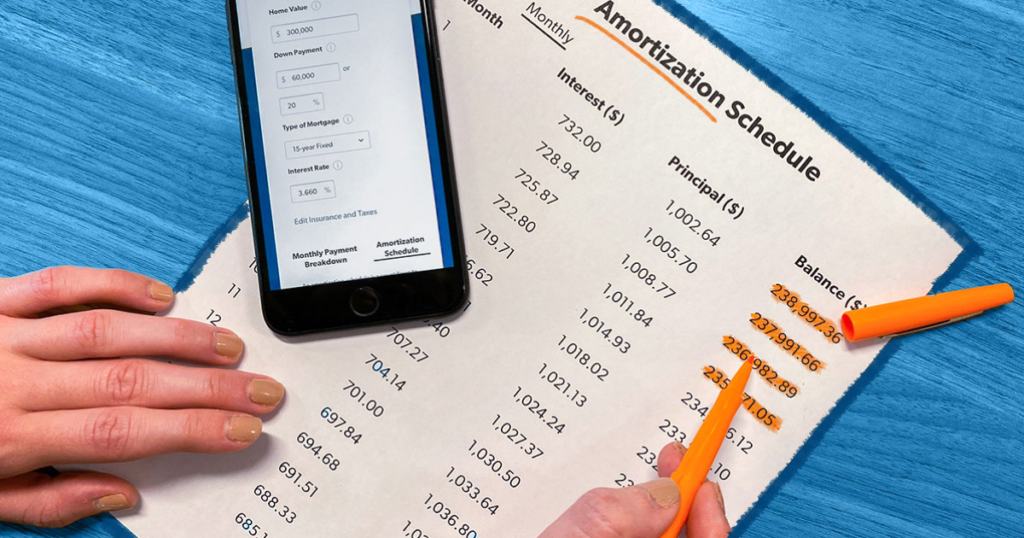

An amortization calculator can also help you understand how your loan works and how your payments are divided between the principal (the amount borrowed) and the interest (the cost of borrowing). It can show you an amortization table, which is a table that shows how your loan balance and interest payments change over time. It can also show you an amortization chart, which is a graph that shows your payments and balances in a visual way.

To use an amortization calculator, you need to enter some basic information about your loan, such as:

- The loan amount: This is the amount of money that you want to borrow or have already borrowed.

- The interest rate: This is the annual percentage rate (APR) that the lender charges you for the loan. The APR includes both the interest and any fees or charges that apply to the loan.

- The loan term: This is the length of time that you have to pay back the loan. The loan term can be expressed in years or months.

- The payment frequency: This is how often you have to make your loan payments. The payment frequency can be monthly, biweekly, weekly, or daily.

- The extra payment: This is an optional amount that you can pay in addition to your regular payment to reduce your loan balance and interest faster. You can choose to make extra payments monthly, yearly, or as a one-time payment.

Once you enter these details, the amortization calculator will show you:

- The monthly payment: This is the amount of money that you have to pay each month towards your loan principal and interest.

- The total payment: This is the total amount of money that you will pay over the life of the loan, including both the principal and the interest.

- The total interest: This is the total amount of interest that you will pay over the life of the loan.

- The payoff date: This is the date when you will finish paying off your loan if you follow the regular payment schedule.

- The early payoff savings: This is the amount of money that you can save on interest if you pay off your loan early by making extra payments or paying a lump sum.

- The amortization table: This is a table that shows how your loan balance and interest payments change over time. It shows how much of each payment goes towards the principal and how much goes towards the interest. It also shows how much principal and interest you have paid so far and how much you still owe.

- The amortization chart: This is a graph that shows your payments and balances in a visual way. It shows how your payments are divided between principal and interest and how your balance decreases over time.

There are many online tools that offer free amortization calculators for different types of loans. For example, here are some web pages that I have found for you on Bing:

- Amortization Calculator: This page from Calculator.net provides a simple and versatile amortization calculator that can handle various types of loans, such as amortized loans, deferred payment loans, and bonds. It also shows an amortization table and a graph of your payments.

- Amortization Calculator With Printable Schedule: This page from Calculators.org provides an amortization calculator with a printable schedule that can create a detailed amortization schedule for any type of loan.

- Amortization Schedule Calculator: This page from Bankrate.com provides an amortization schedule calculator that can help you estimate your monthly loan payments and see how they change over time. It also shows how much interest you will pay over the life of the loan.

Using an amortization calculator can help you plan your loan repayment and save money on interest. However, you should also consider other factors before taking out a loan, such as your income, expenses, credit score, and financial goals. You should also compare different loan offers and read the terms and conditions carefully before signing any contract.

A mortgage loan is a type of loan that you get from a bank or a building society to help you buy a property. Usually, you have to pay a certain percentage of the property’s value as a deposit, and the lender will lend you the rest of the money. You then have to pay back the loan with interest over a fixed period of time, usually 25 to 30 years.

The amount of money that you can borrow and the interest rate that you have to pay depend on various factors, such as your income, your credit score, your savings, the value of the property, and the type of mortgage that you choose. There are different types of mortgages available in the UK, such as:

- Fixed-rate mortgages: These are mortgages where the interest rate stays the same for a certain period of time, usually 2 to 5 years. This means that your monthly payments will not change during this period, regardless of any changes in the market interest rates. This can give you more certainty and stability, but you may miss out on lower rates if the market rates go down.

- Variable-rate mortgages: These are mortgages where the interest rate can change at any time, depending on the market conditions and the lender’s policy. This means that your monthly payments can go up or down, depending on how the interest rate moves. This can give you more flexibility and potential savings, but also more risk and uncertainty.

- Tracker mortgages: These are a type of variable-rate mortgages where the interest rate is linked to a benchmark rate, usually the Bank of England base rate. This means that your interest rate will move up or down by the same amount as the base rate. For example, if the base rate is 0.5% and your tracker rate is 2%, your interest rate will be 2.5%. If the base rate goes up by 0.25%, your interest rate will go up to 2.75%.

- Discount mortgages: These are another type of variable-rate mortgages where the interest rate is set at a certain percentage below the lender’s standard variable rate (SVR). The SVR is the default rate that the lender charges to its customers, and it can change at any time at the lender’s discretion. For example, if the SVR is 4% and your discount rate is 1%, your interest rate will be 3%. If the SVR goes up by 0.5%, your interest rate will go up to 3.5%.

To find out more about mortgage loans in the UK, you can visit some of the web pages that I have found for you on Bing:

- Mortgage Comparison & Mortgage Rates | MoneySuperMarket: This page provides a mortgage comparison tool that can help you find and compare different mortgage products from various lenders in the UK. It also provides information and advice on how to choose and apply for a mortgage.

- Mortgages | Home Mortgage Loans | Wells Fargo: This page provides information and services for home mortgage loans from Wells Fargo, one of the largest banks in the US. It also provides tools and resources for homebuyers and homeowners, such as calculators, guides, and tips.

- Mortgages in the UK: rates and costs | Expatica: This page provides an overview of mortgages in the UK for internationals who want to buy a property in the country. It covers topics such as eligibility, types of mortgages, interest rates, fees, taxes, and insurance.

About the Author

0 Comments