A loan payment calculator is a tool that can help you estimate how much your monthly repayments will be, how much interest you will pay, and how long it will take you to pay off your loan. A loan payment calculator can be useful for various types of loans, such as personal loans, mortgages, car loans, student loans, and more.

A loan payment calculator can help you plan your borrowing by allowing you to compare different loan scenarios and options. For example, you can see how changing the loan amount, the interest rate, or the loan term can affect your monthly payments and the total cost of the loan. You can also see how making extra payments or paying off your loan early can save you money on interest.

Related articles

1- Principal Financial Group 401k

2- Certified Financial Advisor

A loan payment calculator can also help you assess your affordability and budget by showing you how much of your income will go towards your loan repayments. This can help you avoid borrowing more than you can afford and getting into financial trouble.

To use a loan payment calculator, you need to enter some basic information about your loan, such as:

- The loan amount: This is the amount of money that you want to borrow or have already borrowed.

- The interest rate: This is the annual percentage rate (APR) that the lender charges you for the loan. The APR includes both the interest and any fees or charges that apply to the loan.

- The loan term: This is the length of time that you have to pay back the loan. The loan term can be expressed in years or months.

- The payment frequency: This is how often you have to make your loan repayments. The payment frequency can be monthly, biweekly, weekly, or daily.

Once you enter these details, the loan payment calculator will show you:

- The monthly payment: This is the amount of money that you have to pay each month towards your loan principal and interest.

- The total payment: This is the total amount of money that you will pay over the life of the loan, including both the principal and the interest.

- The total interest: This is the total amount of interest that you will pay over the life of the loan.

Some loan payment calculators may also show you other information, such as:

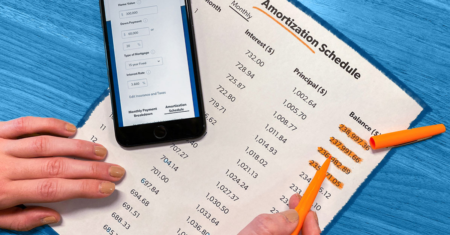

- The amortization table: This is a table that shows how your loan balance and interest payments change over time. It shows how much of each payment goes towards the principal and how much goes towards the interest. It also shows how much principal and interest you have paid so far and how much you still owe.

- The payoff date: This is the date when you will finish paying off your loan if you follow the regular payment schedule.

- The early payoff savings: This is the amount of money that you can save on interest if you pay off your loan early by making extra payments or paying a lump sum.

There are many online tools that offer free loan payment calculators for different types of loans.

For example, here are some web pages that I have found for you on Bing:

- Loan Calculator: This page from Calculator.net provides a simple and versatile loan calculator that can handle various types of loans, such as amortized loans, deferred payment loans, and bonds. It also shows an amortization table and a graph of your payments.

- Free Personal Loan Calculator: This page from MoneySuperMarket.com provides a personal loan calculator that can help you find out how much a personal loan will cost you and what you can afford to borrow. It also compares some of the top offers from different lenders.

- Personal Loan Calculator – Work Out Your Repayments: This page from MoneySavingExpert.com provides a personal loan calculator that can help you work out your monthly repayments and total interest for any type of personal loan. It also gives some tips on how to find cheap loans and avoid common pitfalls.

What is an amortization table?

An amortization table is a table that shows how a loan is paid off over time. It shows the amount of each payment that goes towards the principal (the amount borrowed) and the interest (the cost of borrowing). It also shows the remaining balance of the loan after each payment.

An amortization table can help you understand how your loan works and how much it will cost you in total. It can also help you plan your budget and see how making extra payments or paying off your loan early can save you money on interest.

You can use a loan payment calculator to create an amortization table for any type of loan, such as a personal loan, a mortgage, a car loan, or a student loan. You just need to enter some basic information about your loan, such as the loan amount, the interest rate, and the loan term. The calculator will then show you your monthly payment, your total payment, your total interest, and your amortization table.

For example, here is an amortization table for a $200,000 mortgage with a 5% interest rate and a 15-year term1:

| Month | Interest | Principal | Ending Balance |

|---|---|---|---|

| 1 | $833.33 | $1,073.41 | $198,926.59 |

| 2 | $829.28 | $1,077.46 | $197,849.13 |

| 3 | $825.21 | $1,081.53 | $196,767.60 |

| … | … | … | … |

| 178 | $43.49 | $1,863.25 | $3,675.62 |

| 179 | $15.32 | $1,891.42 | $1,784.20 |

| 180 | $7.43 | $1,899.31 | $0 |

As you can see from the table, the interest portion of each payment decreases over time, while the principal portion increases. This means that you pay more interest at the beginning of the loan and less at the end. The ending balance shows how much you still owe on the loan after each payment.

If you want to create your own amortization table for any type of loan, you can use one of the online tools that I have found for you on Bing:

- Loan Calculator: This page from Calculator.net provides a simple and versatile loan calculator that can handle various types of loans, such as amortized loans, deferred payment loans, and bonds. It also shows an amortization table and a graph of your payments.

- Loan Amortization Table Calculator: This page from AmortizationTable.org provides a free printable loan amortization table calculator that can create a detailed amortization schedule for any type of loan.

- [Amortization Schedule Calculator]: This page from Bankrate.com provides an amortization schedule calculator that can help you estimate your monthly loan payments and see how they change over time. It also shows how much interest you will pay over the life of the loan.

How can I use an amortization table to save money?

You can use an amortization table to save money by following some of these tips:

- Make extra payments: If your loan allows you to make extra payments without penalty, you can use the amortization table to see how much interest you can save by paying more than the minimum amount each month. You can also see how much faster you can pay off your loan by making extra payments. For example, if you have a $200,000 mortgage with a 5% interest rate and a 15-year term, and you pay an extra $100 per month, you can save $8,886 in interest and pay off your loan 1 year and 9 months earlier1.

- Pay off your loan early: If your loan allows you to pay off the entire balance without penalty, you can use the amortization table to see how much interest you can save by paying off your loan early. You can also see how much money you can free up for other purposes by paying off your loan early. For example, if you have a $200,000 mortgage with a 5% interest rate and a 15-year term, and you pay off your loan after 10 years, you can save $37,199 in interest and have an extra $1,907 per month for other expenses or savings1.

- Refinance your loan: If your loan has a high interest rate or a long term, you can use the amortization table to see how much money you can save by refinancing your loan with a lower interest rate or a shorter term. You can also see how much your monthly payments will change by refinancing your loan. However, you should also consider the costs and fees associated with refinancing, such as closing costs, appraisal fees, and prepayment penalties. For example, if you have a $200,000 mortgage with a 5% interest rate and a 15-year term, and you refinance it with a 4% interest rate and a 10-year term, you can save $39,540 in interest and pay off your loan 5 years earlier, but your monthly payment will increase from $1,581 to $2,0241.

To create your own amortization table for any type of loan, you can use one of the online tools that I have found for you on Bing:

- Loan Calculator: This page from Calculator.net provides a simple and versatile loan calculator that can handle various types of loans, such as amortized loans, deferred payment loans, and bonds. It also shows an amortization table and a graph of your payments.

- Loan Amortization Table Calculator: This page from AmortizationTable.org provides a free printable loan amortization table calculator that can create a detailed amortization schedule for any type of loan.

- [Amortization Schedule Calculator]: This page from Bankrate.com provides an amortization schedule calculator that can help you estimate your monthly loan payments and see how they change over time. It also shows how much interest you will pay over the life of the loan.

About the Author

0 Comments